Welfare vs. the 8th Commandment

Exodus 20:

15 You shall not steal.

(NET Bible®)

Taxation is theft.

--Murray Rothbard

“Taxation is theft.” This is a common battle cry among libertarians, and I voiced it myself for many years. For many libertarians, this logically leads to calls for anarchy, and so I did. As I have grown older and less rash, I can now rationalize taxation for core government services as theft with adequate compensation. For certain services, economies of scale and freeloader problems give government the ability to do more than provide double your stolen moneys’ worth for services like defense, property registration, roads, etc. A minarchist can thus justify some taxation.

Taxation for welfare programs is another matter. If the welfare system resulted in lower crime and fewer beggars, then you might rationalize it as part of personal protection. But this is a rather expensive way to reduce crime, and crime stats hint that welfare as we currently know it makes crime worse. The above argument fails, and so I long remained on the anti-welfare side politically.

(For those who find such reasoning absurd, try this thought experiment. Suppose the Salvation Army were to take up arms to make everyone put money into their pots. Good things would happen to the poor, and the burden of making those things happen would be spread out more evenly. But most people would be taken aback by such actions. What gives a group of people calling themselves The Government the right to do such things?)

But as I got older and more aware of my mortality, I began to wonder at my actions. Jesus’ admonitions against the political Right of his day irritated my conscience. And when I started studying the Bible carefully vs. relying on mainstream sermons, I found that even when the Israelites were borderline anarchists, they had a mandatory welfare system.

A resolution for this dilemma can be found in Leviticus.

Leviticus 25:

23 The land must not be sold without reclaim because the land belongs to me, for you are foreigners and residents with me.

(NET Bible®)

Perhaps the most expensive component of the Biblical welfare system was the fact that the rich were not allowed to buy farmland outright. Every jubilee year the land reverted to the families that first settled the land in Joshua’s day. Another important component was the right for anyone to glean anyone else’s fields after the harvest, and to eat what they could pick by hand before the harvest. Such rights take advantage of a gaping hole in libertarian legal theory (a hole that Murray Rothbard jumped over through hand-waving and insults).

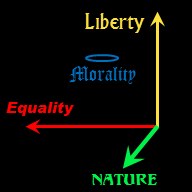

Let us step back and take a quick look at natural rights theory. (For a more in depth look, see “Really Natural Rights.”) According to libertarian natural rights theorists, you own yourself, and by extension what you produce. Since you can do what you will with what you create, you have the right to trade what you create with others, as long as they voluntarily consent to the trade. Such a view disallows any taxation save perhaps for certain government services to the taxpayer as noted above.

This simple theory of natural rights breaks down when you bring in land ownership. Who has a right to the land? John Locke argued that the land should be owned by those who improve the land. Since the products of human labor are mixed with the land, mandatory transfer of the land constitutes a taking of labor, a violation of natural rights.

This is all well and good, but it does not answer the question of who gets the right to mix their labor with the land in the first place. Who gets to build on a strand of beachfront and who must settle for barren desert?

The Biblical answer is that the Holy Land was to be divided equally among families during the initial conquest. From there on, farmland was passed down by inheritance only, with all sons getting a share. Primogeniture was not allowed, but eldest sons did get a double share. Those who did not wish to be farmers could sell a leasehold on their share of the family farm, but could not sell outright. You could not deny your descendants their right to some property.

On the other hand, you could sell land inside of walled cities outright. There, most of the value of land was based on human improvements.

Implementing these ideas outside the Holy Land is problematic since the land was not divided up equally initially, with genealogies traced to this initial division. That said, classical liberal thinkers like Adam Smith, Thomas Paine and Henry George have suggested modern implementations that take care of at least part of the spirit of the jubilee law: tax land based on its unimproved value and distribute the proceeds evenly. The distribution could be in cash or in government services. The libertarian in me prefers the former.

A tax on land value followed by an equal distribution of the proceeds is equivalent to having the land rich pay rent to the land poor. (In ancient Israel, one could only become land rich by leasing land between jubilee years, so there is a great deal of similarity between Henry George’s ground rent redistribution and Old Testament law.) Such a combination of taxation and redistribution provides an equal distribution of the riches inherent in the land while allowing the diligent and the thrifty to keep the results of their labor and savings. Conversely, not having some form of ground rent redistribution or land set aside for the poor constitutes a deprivation of natural rights; it is literally robbing the poor.*

The distribution of such “ground rent” would be unconditional (except perhaps a citizenship condition). As such, it would not punish diligence, thrift or staying married, as does our current welfare system. A dollar given unconditionally is worth far more than a dollar given on the condition of being poor, unmarried with children, or disabled. You can work to better your life while receiving unconditional money.

But such a ground rent distribution would not be an income needed to live in civilized luxury. It would only give everyone enough to rent or make payments on their share of land, minus the value of improvements. We are talking about something on the order of a few thousand dollars per year per person. (This is a rough guess! To get the real answer, determine total land value of the nation. Subtract the replacement value of the improvements such as buildings. Divide by the population and multiply by the current real interest rate. To be more precise, do a similar calculation for the value of broadcast spectrum and extraction of minerals.)

There would still be a need for additional charity to the needy and cheap capital to those born poor or suffering temporary misfortune. Do we rely on private benevolence for these things, or do we need additional taxes and welfare programs? To answer this question, let us first ask how much charity Christians are expected to give voluntarily. Then, we can ask whether this is sufficient to allow government to get out of the forced charity business other than collecting ground rent.

*All this said, many words of caution are in order. Simplistically implementing Henry George’s ideas of ground rent redistribution could result in serious problems and injustices, including:

- Today’s nominal interest rates include an estimate of inflation. Having a ground rent rate equal to the nominal interest rate would be a serious overcharge. To properly follow George’s ideas would mean setting the ground tax rate equal to the real interest rate (nominal rate minus inflation). Since the true inflation rate is impossible to determine (the Consumer Price Index is an educated estimate), this is a challenge.

- Changing from income taxation for welfare to ground rent redistribution would change property values. This could make put many people underwater on their mortgages. A gradual phase-in would be in order! (Then again, today’s property taxes include both ground value and the value of improvements thereon, so the effect may not be that big.)

- Many people have invested in rental property for retirement purposes. Changing the rules late in their lives would be a grave injustice. The aged have paid income taxes while not having the benefits of low property values. To switch from income to wealth taxes would hit today’s retirees and near retirees hard. There needs to be a sizeable age based exception for a time.

- Large land holdings can provide valuable wildlife habitat. Aristocrats have their uses! In order to avoid excessive subdivision, some exemption for maintaining old growth forest and other pristine habitat may be in order.