Inheritance Law in the Bible

Deuteronomy 21:

15 Suppose a man has two wives, one whom he loves more than the other, and they both bear him sons, with the firstborn being the child of the less loved wife.

16 In the day he divides his inheritance he must not appoint as firstborn the son of the favorite wife in place of the other wife's son who is actually the firstborn.

17 Rather, he must acknowledge the son of the less loved wife as firstborn and give him the double portion of all he has, for that son is the beginning of his father's procreative power — to him should go the right of the firstborn.

(NET Bible®)

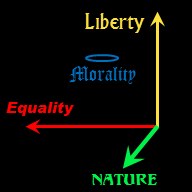

Inheritance is the gray area on the fringe of the capitalist ideal. On the one hand, the right to bequeath is a property right. If you earned it, you have the right to give it to whom you will, including your progeny. On the other hand, defenders of capitalism celebrate equality of opportunity, and decry social justice advocates who call for equality of result. Inheritance violates equality of opportunity; those who inherit a fortune have different opportunities than those who grow up in the projects.

Moreover, those who inherit great wealth often work to undermine the system which gave their ancestors opportunity. The Old Money Club has a history of shutting its doors to newcomers. Science fiction author David Brin has written extensively on the subject, claiming that historically, the political Right has been a bigger enemy of capitalism than the Left. (Personally, I think he undercounts the pre-Marxist Left, but he does make a very important point nonetheless.) For modern examples, check out the conspiracy literature. (No, I do not believe their hierarchical Rockefeller-Rothschild organization for world socialism. But in their quest to support this theory, the conspiracy theorists have gathered many concrete examples of robber-baron scions and their foundations supporting bigger government and less capitalism.)

The Bible resolves the inheritance dilemma in an elegant, and in some ways shocking, fashion.

A Celebration of and Limits on Inherited Wealth

The Bible celebrates inheritance. Israel prospered from Abraham's righteousness. Solomon prospered from David's zeal. The United States prospers from the dedication of our Puritan forebears. The last example is not from the Bible, obviously, but it fits the pattern.

Inherited gifts can remind us to be humble; no fortune is entirely self-made. Furthermore, when God defers rewards to future generations, he tests the faithful. To obey for immediate gain is mere rational self-interest. To obey to bless future generations, however, is to look outside oneself, to exercise benevolence.

Though the Bible celebrates inheritance, it also spreads it out. At least that seems the implication of Deuteronomy 21:15-17. The eldest son does not inherit all. He does get a double share. So if there are 4 sons, the first gets 40% and the other three get 20% each. While this may seem unfair, keep in mind that the eldest is older when he inherits than his younger brothers. He has less time to enjoy his inheritance, and has greater responsibilities that go with his seniority. But still, there is some advantage in being the oldest son.

Compare this, however, with primogeniture, where the eldest son inherits everything. Such was the law during much of the feudal era, an era which was nominally very Christian, yet in reality, less Christian than advertised. Though the governments of the time gave outward obeisance to the Church, they also worked to control the Church, with some degree of success. So for those of you who scoff at Christianity, who think that the Bible has little to offer, and cite the Middle Ages as evidence, note this very important difference between Biblical Law and feudalism. Feudalism is impossible under Biblical Law.

Read the Law above again. It refers to two wives. Rich men could afford more than one wife and/or concubine. Feel free to be shocked and cite it as sexist, but Biblical polygamy had a progressive feature: polygamy results in many sons. Many sons divide up large estates in a few generations. Future generations must go back to work to stay wealthy even without inheritance or estate taxes. Instead, the family that succeeds, breeds. Consider the effect on the gene pool. Old Testament Law was Darwinian.

Potential Modern Applications

Suppose we were to apply the ancient Law today. A virile superstar such as Magic Johnson would have acquired multiple wives from his vast pool of adoring fans, instead of an unsanitary succession of one-night trysts. Since the Law would require him to service all of his wives [Exodus 21:10], even such a mighty one as Magic Johnson would find his limit, leaving other women available for lesser men. With marriage comes offspring. The future NBA would benefit from a larger pool of Magical sons to recruit from. And with the sons dividing the spoils of a heroic basketball career, we need not fear a future feudal Johnson dynasty.

OK, I jest. Polygamy has its problems, and Jesus deprecated the practice. But it is worthwhile to also see its advantages, lest we scoff at the ancient Law as primitive.

Now to a politically correct modern application: if unearned wealth concentration is the problem, then estate taxes are not the solution. Progressive inheritance taxes are. It is not the size of the estate that is the concern -- as long as the estate was honorably earned. The problem is too much power in the hands of those who did not earn it. If we tax inheritance instead of estates, then a fading tycoon can dodge the tax man by dividing his estate to extended family and even friends. The result would be a broader upper class: more donors, self-funded politicians, and angel investors to choose from.

If we treat each inheritance as a separate event, then the upper classes could conspire to bypass the tax by cross-bequeathing: you name my children and I'll name yours. The remedy is simple. Let each person have an annual deduction to apply to all inheritances and gifts. Deductions not used carry over to future years. If you receive or inherit up to the deductible from one benefactor, it is tax free, but any subsequent gifts/inheritances are taxed at the full rate that year. And the deductible takes a while to build back up for subsequent years.

This arrangement solves the generation-skipping problem as well. Suppose the deductible is $50,000 per year. Joe Money-Bags has 3 million dollars to pass on. He could give it to his 50 year old son with only $500,000 taxable, or his 25 year old grandson with $1,750,000 taxable, or to his 5 year old great grandson with $2,750,000 taxable. These numbers assume no gifts prior to inheritance. Adjust accordingly for gifts (which can be treated the same as inheritance).

The numbers I just used are for example purposes only. I leave it up to the reader to decide on a fair annual deductible, ditto for whether we should have any inheritance tax. For extra credit, you can design multiple inheritance tax brackets with similar accumulating deductibles.